March 19, 2025

VIDEO: Weekly California Water Market Report

Discussions for 2025 Spot Market Transfers Begin

Allocations are currently low, but typical for this point in the year. Water supplies south of the delta (“SOD”) are currently below normal. Depending on the impact of recent storms, allocations may be updated at the end of the month.

Market participants with carryover supplies are wary of reservoir levels. Reservoir levels are between 75% and 85% of capacity and will need room to collect snowmelt in the upcoming months. Carryover supplies will probably be lost as flood releases if unused within the next couple of months. This has driven market activity over the last few weeks.

Much like 2024, transfer activity is limited. In the SOD market contractors are waiting for a potential increase in allocations. In the North of Delta (“NOD”) market, participants have ample supplies with 100% allocations and high reservoir levels. Overall discussions of market transfers in 2025 are limited. Parties initiating discussion are those who have regular annual transactions or who have multi-year transfer agreements. Sellers include major contractors who do not need their entire supply enabling them to regularly participate in early-season spot market transactions.

Upcoming transactions are of 2024 carryover supplies. Over 7,600 AF of carryover supplies are undergoing approvals to be transferred in upcoming weeks at prices ranging from $150/AF to $225/AF. Potential transfers of 2025 supplies are still in negotiation, and it is currently unclear when they will be executed.

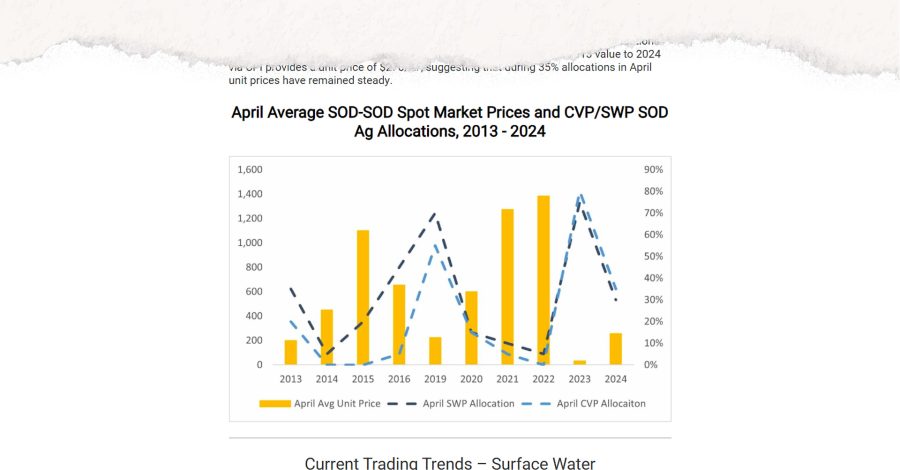

Spot market transfers of 2025 supplies will likely begin in April. The prices and volumes transacted historically vary with allocations in April. In low allocations years, (<20%) prices are typically over $1,000/AF while in higher allocations prices are closer to $450/AF. In extremely wet years such as 2023, average prices were $33/AF, an all-time low between 2013 and 2024.

At current allocations of 35%, prices are expected to average near $260/AF. In 2013, April allocations were 35% and the average unit price was $200/AF. Last year April allocations were also 35% and the average unit price was $258/AF. Adjusting the 2013 value to 2024 via CPI provides a unit price of $270/AF, suggesting that during 35% allocations in April unit prices have remained steady.

Stay informed on California’s water market by subscribing to our weekly report at waterexchange.com/ca-water-index

Want to dive deeper into water market trends? Join us at the Sustainable Water Investment Summit to gain valuable insights from industry leaders and explore strategies for navigating the evolving market landscape. sustainablewaterinvestment.com